When it comes to electronic article surveillance, people most often associate security tags with protecting clothing from theft.

And it’s true, in the past, apparel protection was indeed a popular use for security tags.

But over the years the design and technology of security tags has extended to encompass far more than just clothing, and now they can be applied to bottle tops, eyewear, electronics, fashion accessories and so much more.

So, let’s look to the other uses for security tags and how they’ve come to protect far more than apparel.

A little history

When it comes to electronic article surveillance, people most often associate security tags with protecting clothing from theft.

And it’s true, in the past, apparel protection was indeed a popular use for security tags.

But over the years the design and technology of security tags has extended to encompass far more than just clothing, and now they can be applied to bottle tops, eyewear, electronics, fashion accessories and so much more.

So, let’s look to the other uses for security tags and how they’ve come to protect far more than apparel.

Popular option for apparel

The simple design of security tags makes them a natural loss prevention strategy for apparel. Each tag features a transmitter which communicates with an antenna at the entryway of the store.

The tag is affixed to clothing via a pin that passes through the item and locks into the transmitter housing.

Easy to attach, the system provides a simple and effective option for protecting clothing. Tags can also be quickly removed at the point of sale using a specialised detacher and then re-used.

Over the years, however, innovation and design refinements have enabled the security tag to protect far more than just clothing.

Lanyards and cables

The addition of lanyards and cables allows security tags to be affixed to products including fashion accessories, handbags, and even shoes.

This simple fixture sees the cable lock into the tag where the transmitter is housed and offers a wealth of flexibility in terms of products it can be applied to.

Importantly, the lanyard or cable removes the need for a pin to pass through a product, making this method ideal for high-value products made of materials like leather.

Liquor bottles and eyewear

In addition to hard tags, lanyards and cables, security tags have also been developed for specific purposes.

These include tags which protect liquor, eyewear, and even baby formula from theft.

For example, liquor bottle tags affix to the cap of a bottle and stop the product being stolen or consumed in-store, while optical tags grip firmly onto the arm of eyewear, but are small enough not to interfere with the customer experience of the product.

Spider wraps

Another innovation of the security tag is the spider wrap, which sees expandable cables wrap around a product then lock into a tag. The tag sounds an alarm when a product is being removed from a store or when the cables are tampered with.

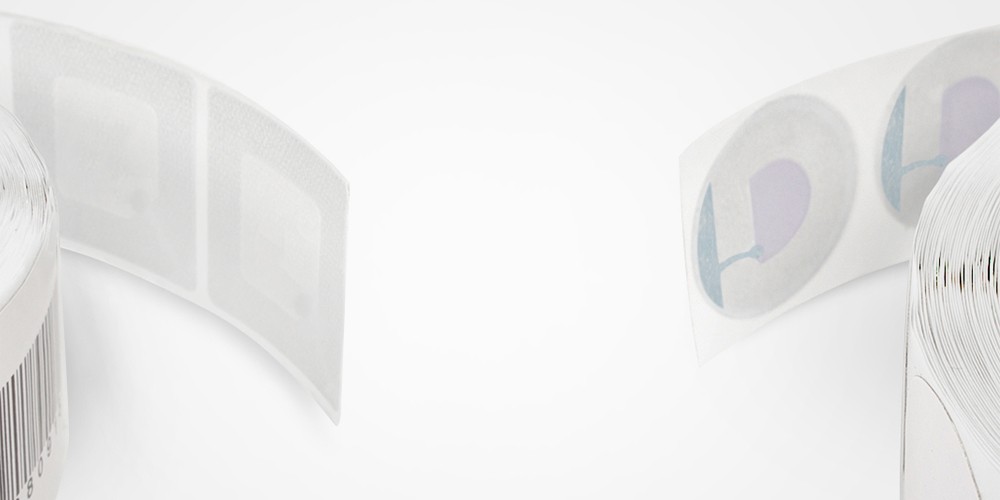

Security labels

Meanwhile, EAS has also evolved to include security labels, which are often used for low value, high volume products.

These work on the same principle as security tags, but are deactivated, rather than detached at the point of sale, and are used to protect products like books, CDs, pharmaceuticals and more.

For more information on finding the right tag or label to suit your loss prevention needs, see here, or contact our team directly for further advice.